Before Arlo: After Arlo:

Arlo's Value

With Arlo, patients steer their health journey alongside trusted doctors, never trading quality for cost. Up-front prices and rich preventive coverage create healthier people and healthier budgets.

Know the cost of every visit before you book—no hidden fees, no surprise bills.

$0 primary-care copays and covered screenings push members to act early—before small issues get pricey.

Multiple plan options so every budget finds the right fit without sacrificing quality.

Data-driven underwriting locks in predictable renewals, keeping year-over-year increases in check.

Scalable Solution

Ideal for teams of 10–150 employees, Arlo scales with your headcount—delivering big-company benefits without the big-company admin.

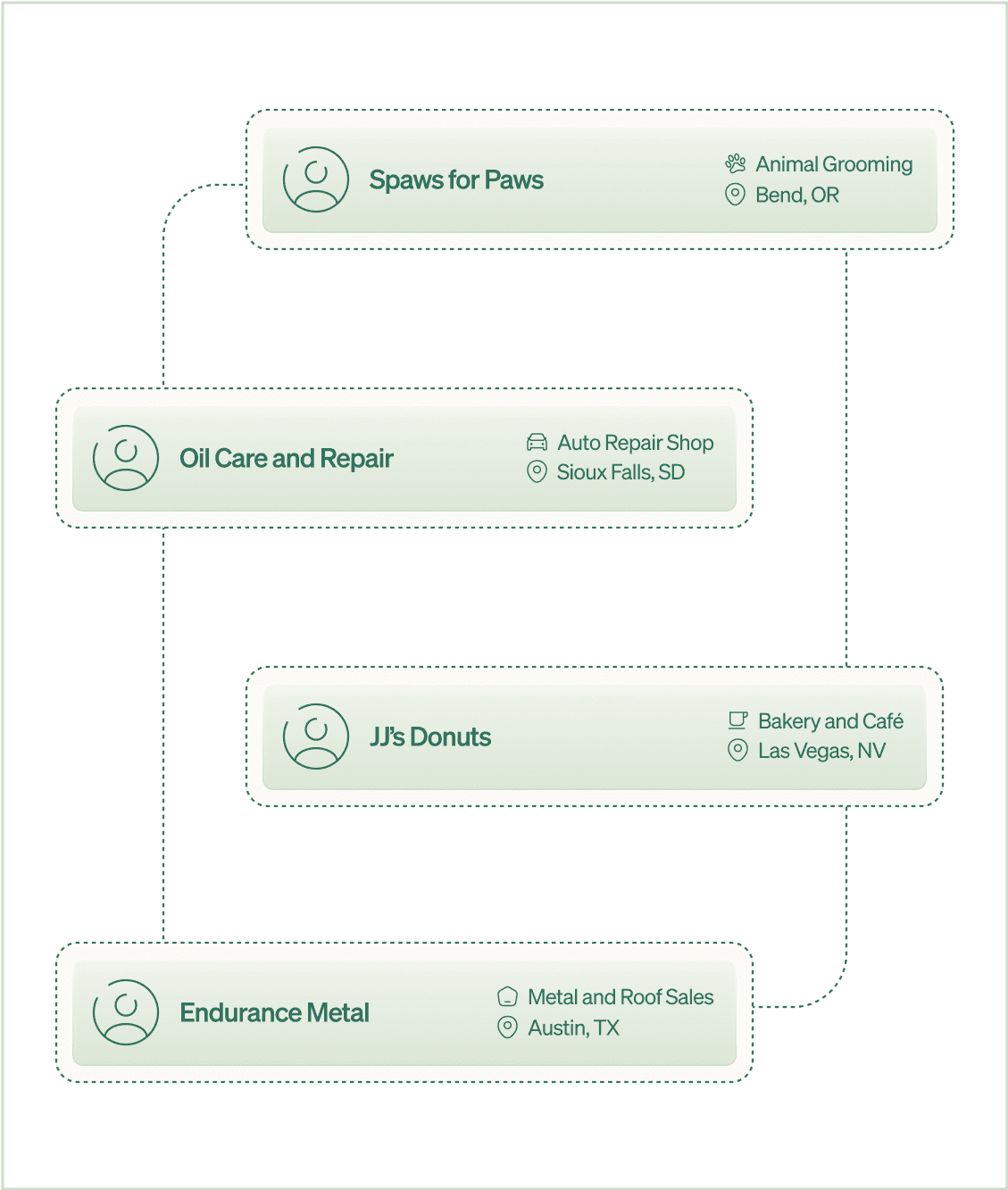

Industry Inclusive

Arlo is available for any kind of industry. We range from day care centers, automotive shops, or technology startups.

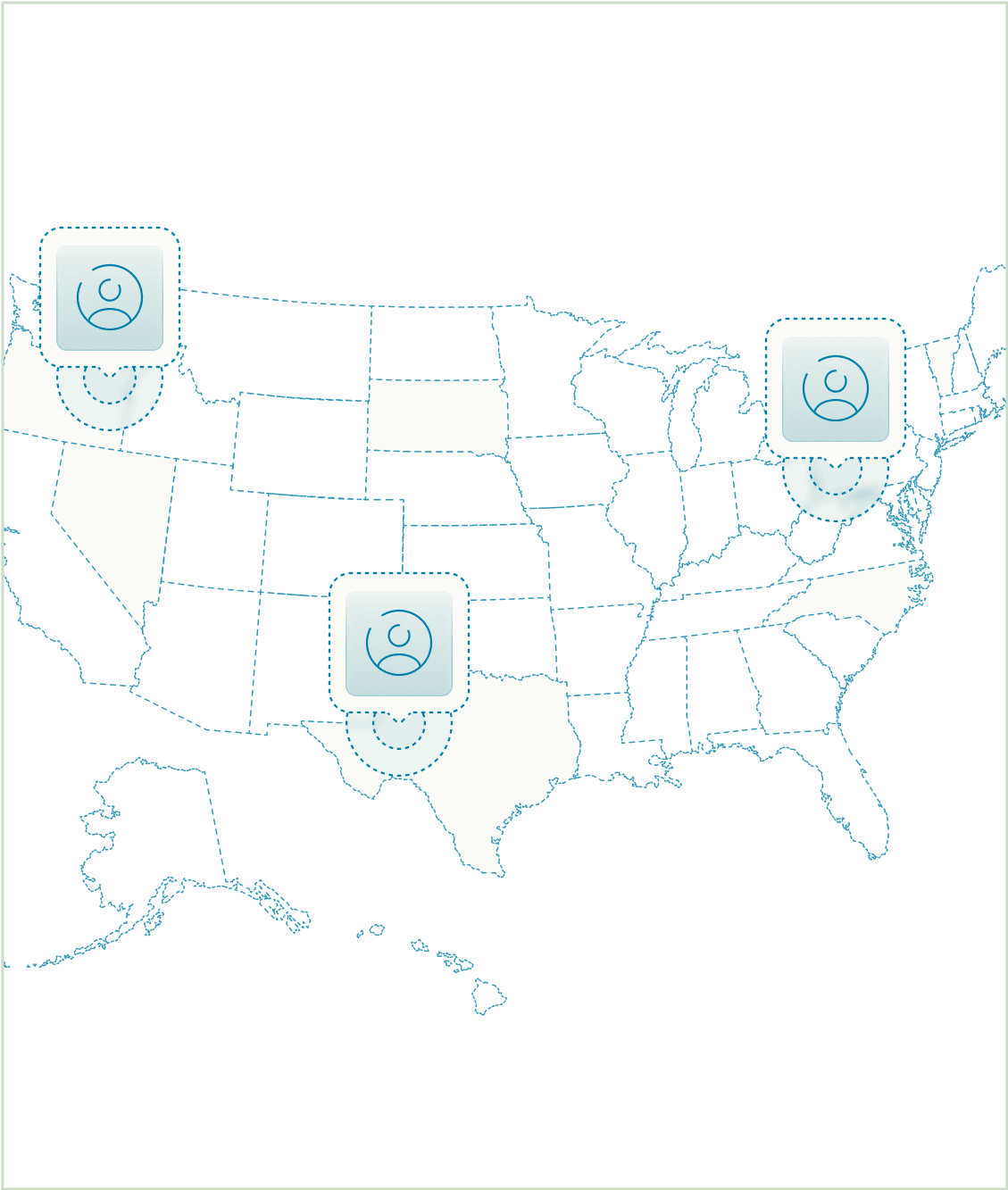

Available Nationwide

Arlo offers coverage across the country, with availability in most states – excluding WA, NY, HI, DC, and OK.

Scalable Solution

Ideal for teams of 10–150 employees, Arlo scales with your headcount—delivering big-company benefits without the big-company admin.

Industry Inclusive

Arlo is available for any kind of industry. We range from day care centers, automotive shops, or technology startups.

Available Nationwide

Arlo offers coverage across the country, with availability in most states – excluding WA, NY, HI, DC, and OK.

Key Benefits

The Arlo Advantage

Zero-Cost Everyday Care

Smarter Access, Less Stress

Personalized Concierge Support

Care that Reaches Out

Concierge Support, Zero HR Headaches

Predictable Pricing, Year After Year

Simple to Administer, Easy to Love

Fewer Hassles, More Health

Key Benefits

The Arlo Advantage

Zero-Cost Everyday Care

Smarter Access, Less Stress

Personalized Concierge Support

Care that Reaches Out

Concierge Support, Zero HR Headaches

Predictable Pricing, Year After Year

Simple to Administer, Easy to Love

Fewer Hassles, More Health

Powering Broker Success with Better Healthcare

Powering Broker Success with Better Healthcare

Arlo gives brokers a faster, sharper way to compete. Instant quotes, live plan analytics, and predictable renewals come bundled with white-glove support—so you win more groups and keep them, minus the back-and-forth.

For businesses

For employees

For Brokers

Trusted by businesses, built for affordability.

From factories to startups, businesses trust Arlo for quality, affordable healthcare. Join hundreds of employers choosing a smarter way to offer benefits.

day cares

auto shops

tech startups

design agencies

accounting firms

bakeries

financial institutions

retail

restaurants

Thank you for your submission.

your submission.

We got your message and will be sure to reach out as soon as possible.